Heres your go-to-guide for Malaysia visa for Indians. 150 countries such as European Union EU UK Canada New Zealand Australia Singapore Malaysia etc have implemented this form of tax.

AIA Vitality members can also access their AIA Vitality account via this app.

. For more details on the step-by-step guide please refer to the Direct Credit Registration User Guide. Andor AIA General Berhad collectively known as AIA Malaysia. VAT refers to Value Added Tax.

Right from document submission to getting your visa in your inbox this is a 100 automated solution which we have designed. For the entire list of 21 offenses please go to our main article on offenses. You can register and use this app as long as you are the policy owner of an individual policycertificate have an active employee benefit plan or mortgage account with AIA Bhd AIA PUBLIC Takaful Bhd.

Updatere-activate the One-Time-Password OTP mobile number Great ID Request to Update Mobile Number. There are 21 offenses under GST. Standard Procedures for Incorporation in Malaysia.

In other countries GST is known as the Value-Added Tax or VAT. Commonly Faced Problems by Foreigner When Doing Business in Malaysia. Direct Credit Facility Form.

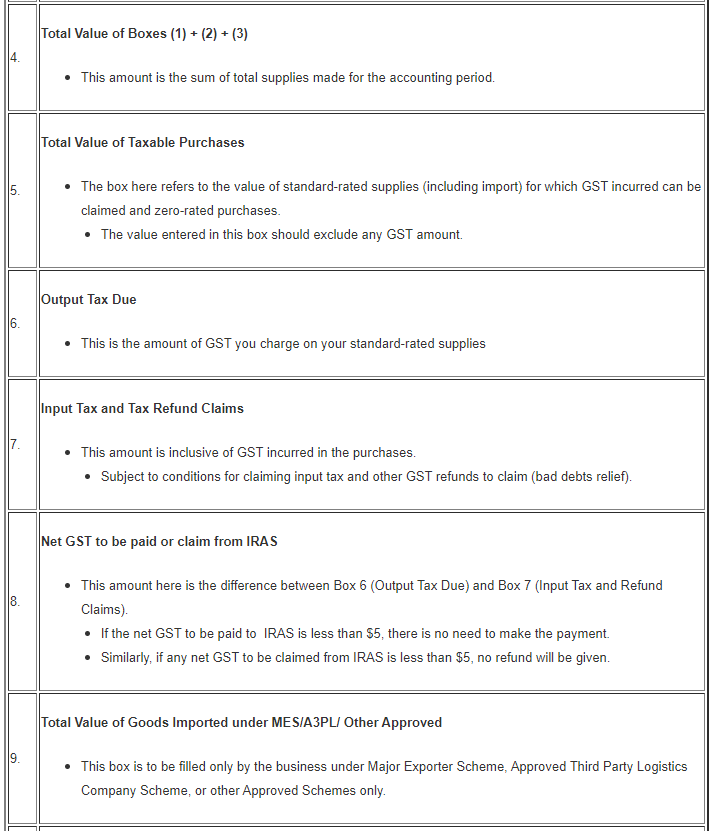

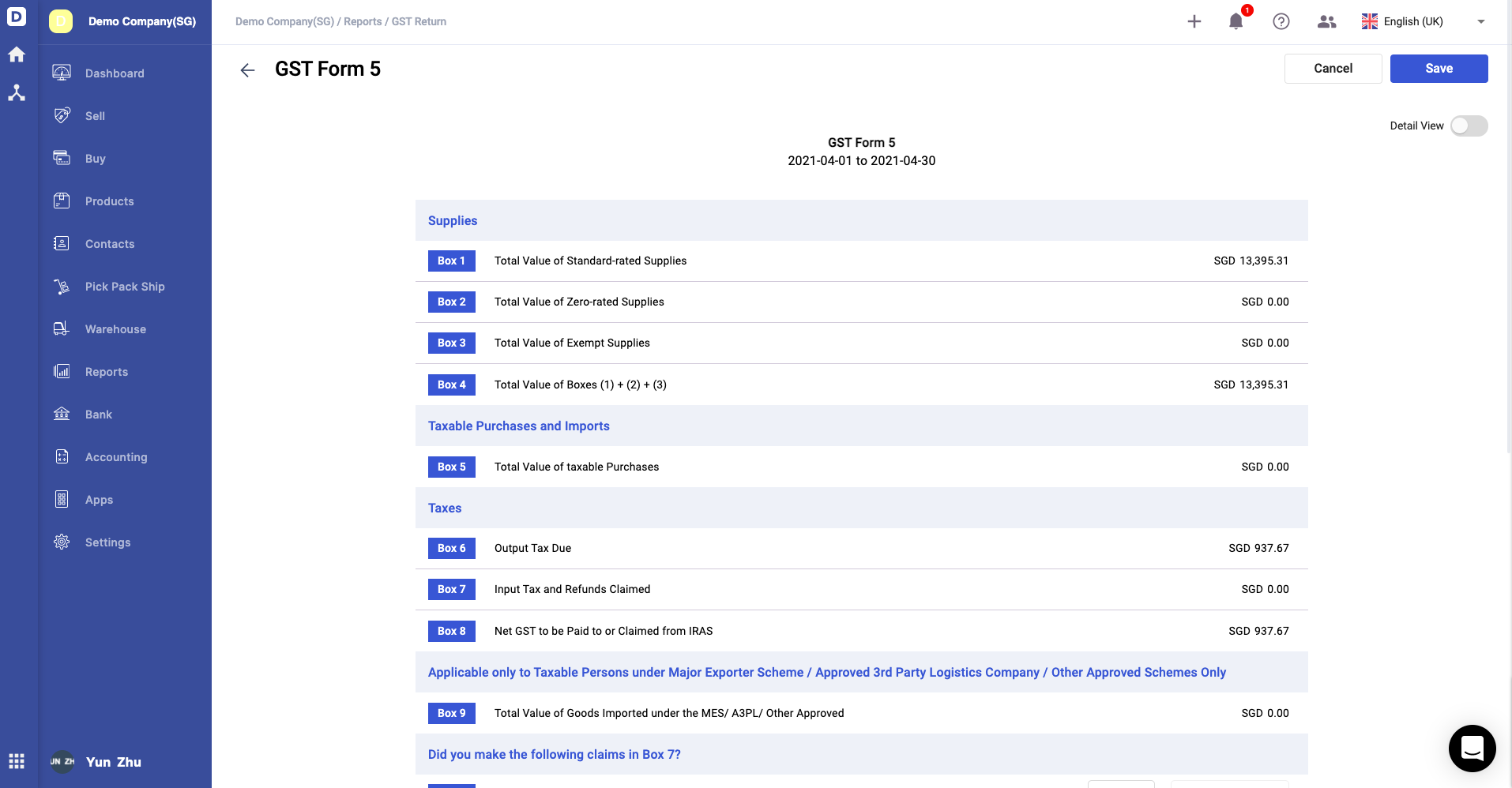

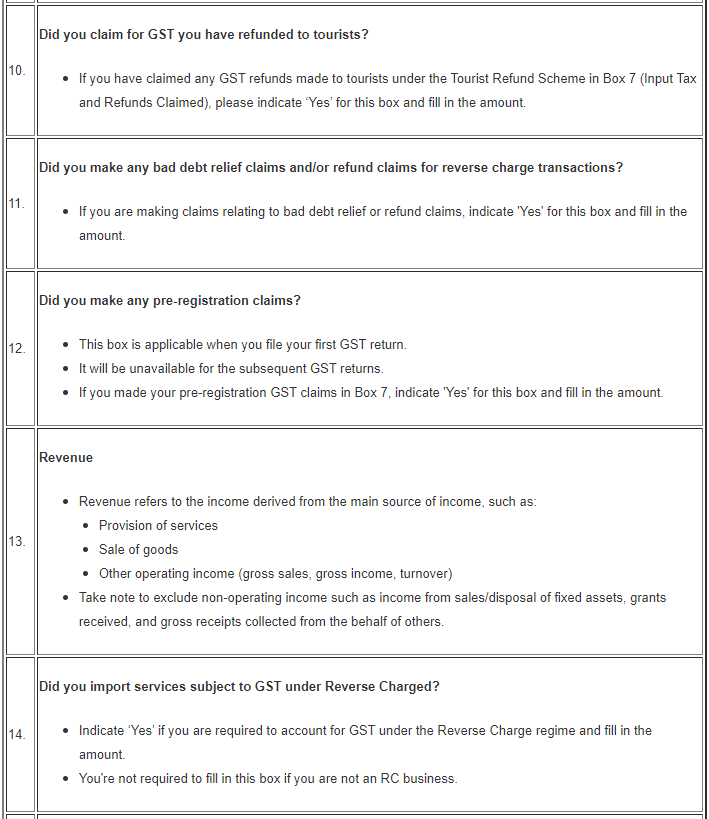

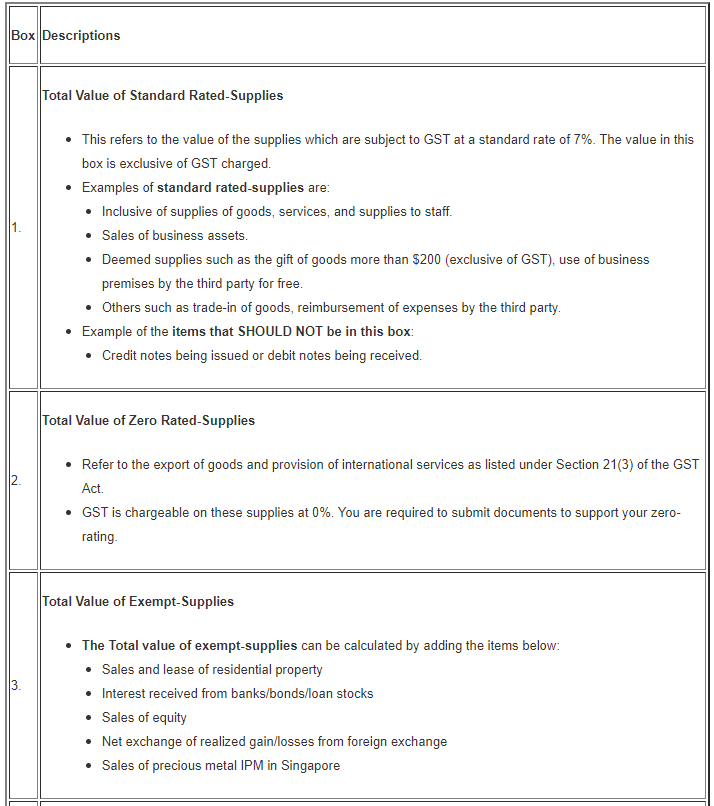

We have mentioned a few here. Goods and Services Tax or GST meaning is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore. HP internal research of printer manufacturers published specifications as of Sept 4 2018 and Keypoint Intelligence-Buyers Lab 2018 study.

FEATURES 1 Smallest in-class footprint compared only to dimensions of majority of worldwide competing personal color laser printers defined as non-discontinued color laser printers. An Expatriate Guide to Starting a Business in Malaysia as Foreigner. Admin fee for change in Invoice payer for GST INR 250 Late Shipping Instruction Submission fee - effective 09 April 2021 USD 120.

Teu INR 495 per Teu. The major offenses under GST are. In 2018 consumers in UAE are expected to pay a 5 per cent value-added tax.

One of the primary reasons MNCs are eager to set up a business base in Malaysia is due to the lower operational costs involved. To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest. Gate In Charge effective 10 November 2021.

In case your visa is rejected by the Malaysia Embassy the Malaysia visa fees will not be refunded. Online submission is available in e-Connect. Guide to Start Business in Malaysia.

200 USD and color laser MFPs 300 USD. Guide to Malaysia Company Registration. TOL Charge effective 17 April 2022.

Malaysia is the third largest economy in South East Asia and has now become an upper middle income and export-oriented economy. This post is also available in. Request for reinstatement of policy.

Melayu Malay 简体中文 Chinese Simplified MNCs in Malaysia. Container Seal Charge effective 15 Sept 2018. Overview of Goods and Services Tax GST in Singapore.

Guide to Select Your Malaysia Company Names. Offences Penalties Offences.

Gstr 3b For Finalization Of Inward Outward Supplies Eztax

Malaysia Accounting Software Best Accounting Software Accounting Accounting Software

Gstr 10 Details Return Filing Format

Filing Your Gst Return Gst Guide Xero Sg

Gst Return Is Not Filed What Happens Then Incorp Advisory

Due Dates For Gst Returns Types Of Gst Returns Ebizfiling

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

How To Prepare Excel Sheet To File Gst Return For Online Seller 2020 B Excel Online Seller Preparation

How To Use Gst Return Center To Efile Eztax In Gst Help Center

Filing Of Gst Return Video Guide Youtube

What Is Gst And How Does It Work Infographic Xero Sg

Filing Of Gst Return Video Guide Youtube